October 4 2024

The PIB Group (“The Group”) delivers 6% organic growth in revenue and improved operating margin

Unaudited Operating Performance and Key Highlights1:

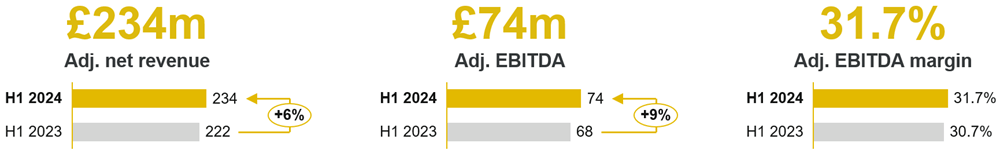

- Organic revenue growth of 6% across UK & Ireland Advisory, Programs, London and International Markets

- Growth in Cost Base contained below growth in revenues with benefits from integration and improved cost management.

- 9% growth in adj. EBITDA coupled with 1% margin expansion

M&A Update:

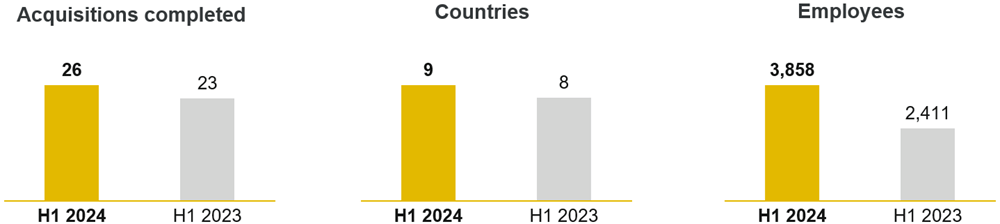

In the first half of 2024, The Group successfully completed twelve acquisitions, furthering the growth momentum established in prior years. This includes four acquisitions in Spain and one acquisition in Romania, significantly enhancing The Group’s presence in Europe and reinforcing its vision to become a leading and dominant player in both the UK and European insurance brokerage market.

During the first half of the year The Group has made the following acquisitions:

- Lir Insurance – Commercial Insurance Broker in Ireland

- FitzGerald Flynn – Life Insurance Broker in Ireland

- JS Consultores – Commercial Insurance Broker in Spain

- Inside 2.0 – Commercial Insurance Broker in Italy

- Stein Broker – Commercial Insurance Broker in Romania

- Youatwork – Employee Benefits Insurance Broker in the UK

- Equinum – Commercial Insurance Broker in Poland

- Fabroker – Commercial Insurance Broker in Spain

- AML Insurance Brokers – Commercial Insurance Broker in Ireland

- Mone – Commercial Insurance Broker in Spain

- Hector – Motor Insurance Broker in Germany

- SARE – Commercial Insurance Broker in Spain

Capital Management:

The Group aims to maintain an affordable and efficient level of debt aligned with our target leverage, interest cover, debt maturity profile, and sustainable capital structure. The current debt facilities and utilisation as at 30 June 2024 are summarised in the table below:

| Facility | Facility size (£’m) | Drawn (£’m) | Unutilisesd (£’m) | Repayable Date |

| B3 | 1,172 | 1,172 | - | May-2031 |

| PIK | 275 | 200 | 75 | Mar-2033 |

| ACF4 | 300 | - | 300 | May-2031 |

| RCF | 162 | - | 162 | Nov-2030 |

| Total | 1,909 | 1,432 | 537 |

|

Following the refinancing of The Group’s debt facilities in H1 2024, The Group successfully increased unutilised debt capacity by £388m, compared to 31 December 2024. This was achieved through the consolidation of all existing debt into a new fully drawn B3 loan facility of £1,172m; and establishing a new £300m ACF 4 facility. The RCF was upsized in May 2024 to £162m and was undrawn at 30 June 2024. A partial draw of £60m has subsequently occurred at the end of August 2024. The new PIK facility of £275m established in March 2024 was £200m drawn on inception.

Outlook:

The outlook for H2 2024 and beyond is positive as The Group continues its growth trajectory, driven by both acquisitions and organic growth across Europe. The Group continues to invest in new European hubs to support expansion in existing countries; whilst balancing continued delivery of strong and improving margins. The M&A pipeline is at its strongest for several years and The Group expects 2024 to be as active as 2023 by the end of the year, including acquisitions in two new countries.

1 Refer to page 30 of the PIB Group Annual Report and Financial Statements for the Year ended 31 December 2023 Glossary for the basis of calculations for KPIs